Content

In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid. When you useRevenue Onlineto file taxes, the online form includes all the tax rates for each of your business locations. If you have more than one location, you must file each location separately in the Revenue Online service. You may e-file for multiple locations using approved XML software or request to file by spreadsheet, both of which are uploaded in Revenue Online.

If you’re working with a developer, they cantake advantage of the Avatax APIto build sales tax rate determination into your application. A 1979 study published by the Tax Foundation offered some insight into arguments for or against VAT as compared to sales tax. Perhaps the greatest benefit of taxation via VAT is that because taxation applies at every step of the chain of production of a good, tax evasion becomes difficult.

Sales Tax Calculator

States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play. Unlike VAT (which is not imposed in the U.S.), sales tax is only enforced on retail purchases; most transactions of goods or services between businesses are not subject to sales tax. Whether you’re trying to get back to the pre-tax price of an item as part of a word problem or calculating the sales tax backwards from a receipt in your hand, the math is the same. If you sell products to customers who turn around and sell the same product to customers, you might not need to collect sales tax. Instead, your customer, who becomes the seller, must collect sales tax.

The sales tax here in 10%. If I find something I like at the mall ima ship my shit home for the 6%

— Queen 🤍🖤 (@Banks2x_) November 26, 2021

If you are deployed overseas, you can use the calculator to determine the sales tax you paid while you were in the United States. Once find sales tax you’ve calculated the total amount of tax, you add that to the purchase price to get the total price of the item you’re selling.

Round that up to $2.63 for your amount of sales tax. Each state with a sales tax has a statewide sales tax rate.

How To Calculate A Mortgage Payment

It’s more complicated to find your tax rate than to calculate sales tax. Be sure to check with your local state and city when calculating sales tax. We don’t often talk of “city sales tax,” but it’s there. Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost. Import your sales order history every night, be reminded of filing deadlines, and get the local sales tax breakdowns you need in order to file sales tax with each state. Some states may have another type of rate — as a special taxing district.

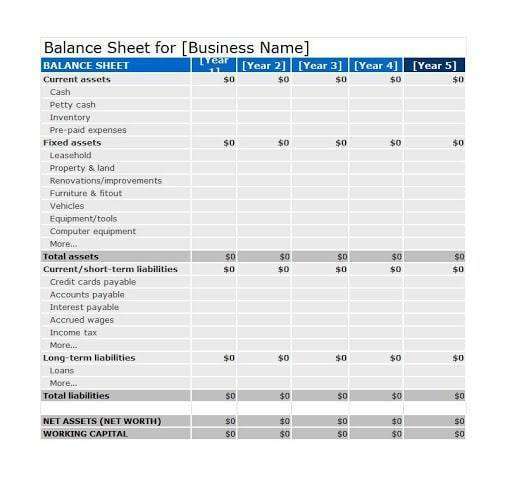

How do you record cost of sales?

You should record the cost of goods sold as a business expense on your income statement. Under COGS, record any sold inventory. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. You can determine net income by subtracting expenses (including COGS) from revenues.

With the help of the community we can continue to improve our educational resources. We can convert 6.75% to a decimal by dividing by 100. Finally, implement the rate shown above to your product or service’s value. When autocomplete results are available use up and down arrows to review and enter to select.

Additional Example Of The Sales Tax Calculation

States use sales tax to pay for budget items like roads and public safety. The state sales tax rate is the rate that is charged on tangible personal property across the state.

Sales tax is just one tax of many in SF. SF has business taxes not find in many other jurisdictions. Add them all up and it's crushing to business.

— MR – Michael Robertson (@mp3michael) November 30, 2021

Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you don’t know the rate, download the free lookup tool on this page to find the right state and local rates. This sales tax rate calculator is powered by the same technology used by sales tax software, except that this tool does not scrub the provided address against the US Postal Service database. Use it to calculate sales tax for any address in the United States.

Example Question #1 : How To Find The Amount Of Sales Tax

Automatically calculate sales tax on transactions, and use reports to prepare sales tax returns. If your business consists of mostly selling products to others who will then resell them, you may not need to pay sales tax. In this instance, it is the seller who pays the sales tax by charging their consumers. Sales tax is a tax on consumers, so if you are not selling your products to someone who will use it, then you likely don’t need to pay the tax. The Sales Tax Deduction Calculator is updated with overseas U.S. military zone and districts where members of U.S. military pay no sales tax.

Calculate 1 percent (in this case, 1.89), multiply that by 9, and add it to 189. “De-calculate” by working backward if you know the original cost of the item. Now, let’s use this information to solve the given problem. Quickly learn which licenses your business needs and let us manage your license portfolio to save time and reduce hassles. Let Avalara put your rates to work when you try Returns for Small Business at no cost for up to 60 days. Supply chain and logistics Identify and apply tariff codes to products for cross-border shipments. No warranty is made as to the accuracy of information provided.

Utah lawmakers and community members want to end the sales tax on food items – KUER 90.1

Utah lawmakers and community members want to end the sales tax on food items.

Posted: Thu, 25 Nov 2021 00:35:00 GMT [source]

For example, the state rate in New York is 4% while the state sales tax rate in Tennessee is 7%. VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. Countries that impose a VAT can also impose it on imported and exported goods.

Revenue And Spending

For many businesses, collecting sales tax is a mandatory part of selling goods and providing services. After collecting sales tax from customers, you are responsible for remitting the tax to your state or local government. But before you start collecting, you need to know how to calculate sales tax.

Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. For more information about or to do calculations involving VAT, please visit the VAT Calculator. The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. In Texas, prescription medicine and food seeds are exempt from taxation. Vermont has a 6% general sales tax, but an additional 10% tax is added to purchases of alcoholic drinks that are immediately consumed.

If your New Jersey business sells both t-shirts and toys, you should charge a sales tax on the toys and not the shirts. Businesses should learn what products are exempt from the sales tax in their area and regularly check for changes. The deduction for state and local general sales tax is meant to be the amount of sales tax you actually paid. Rather than require you to keep all of your receipts, the tax law allows you to use the optional sales tax tables provided by the IRS. This lets you approximate your sales tax payments using average consumption patterns, taking into account the relevant tax rates and your income and family size. When selling online, you first need to determine if you are required to collect sales tax from buyers in your buyer’s state.

This assumes residents purchase taxable items throughout the locality, not just in the taxing jurisdiction where they reside. The sales tax formula is used to determine how much businesses need to charge customers based on taxes in their area. State and local governments across the United States use a sales tax to pay for things like roads, healthcare and other government services. Sales tax applies to most consumer product purchases and exists in most states. If you sell from one location, like a retail storefront, find out your local sales tax rate and charge that rate to all customers. You can find your sales tax rate with a sales tax calculator or by contacting your state taxing authority. If your local sales tax rate is 8.5%, then you would charge 8.5% sales tax on all transactions.

Just like states use sales tax to pay for public safety, etc. so do local areas. Determining which laws apply to your business is hard, but it’s a crucial step toward compliance. For more information, please refer to ourseller’s guide to nexus laws and sales tax collection requirements.

Resale Products

Sales tax rates are set by states and local areas like counties and cities. Governments use sales tax to pay for budget items like fire stations or street sweeping. A sales tax is a mandatory amount that the government charges on items purchased by consumers and businesses. The government uses the money obtained from sales taxes for things such as education, health care, road repairs, and transit.

For purchases by mail, phone, or the Internet, input the shipping City & Zip Code, unless your state’s taxation policy is origin-based. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. In our example, $20,000 plus $40,000 equals sales of $60,000. The Federation of Tax Administrators keeps an updated calendar of which states are issuing tax holidays and when, so you can plan ahead.

The countries that define their “sales tax” as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia. Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly. If a due date falls on a Saturday, Sunday or legal holiday, the next working day is the due date. We strongly encourage you to use our online tools, tutorials and other resources for tax services, and establish 24/7 account access on Webfile.

Employees, a physical store, a warehouse presence and other business activities create sales tax nexus. If you have nexus in a state, then that state generally requires you to collect sales tax from buyers in the state.

- To get the sales tax rate you need you must add together all applicable taxes in your location.

- In the U.S., sales tax is a small percentage (usually 4-8%) of a sales transaction.

- In order to calculate the amount of sales tax that Melissa must pay, it’s helpful to convert the sales tax from a percentage to a decimal.

- Sales tax is collected at the time of the transaction.

He received a CALI Award for The Actual Impact of MasterCard’s Initial Public Offering in 2008. McBride is an attorney with a Juris Doctor from Case Western Reserve University and a Master of Science in accounting from the University of Connecticut. In addition, Erica writes about health, personal relationships and self-improvement for outlets including Goalcast, Reader’s Digest and Parents Magazine. It indicates a way to close an interaction, or dismiss a notification. Menu icon A vertical stack of three evenly spaced horizontal lines.

This includes items you can touch and feel like furniture, coffee cups and books. Since sales tax is governed at the state level, some states have decided not to tax necessities like groceries, clothing or textbooks. Check with your state’s taxing authority to find out if the products you sell are taxable. Follow the steps below to manually back the estimated sales tax amount out of the total sales for each department after you have added tax to item pricing. The sales tax is calculated as a percent of the purchase price. Nailing down the rates is much more complicated than the actual math used to determine how much sales tax you’ll be paying — that’s just a simple percentage. If you’re shopping in most US states and you want to know how much you’ll be paying in total before you check out, here are steps you can take to calculate the sales tax.

For example, New York State has a sales tax rate of 4% and New York City has a sales tax rate of 4.5%. If you are buying or selling a product within New York City, the sales tax rate is 8.5% combined. The sales tax formula is simply the sales tax percentage multiplied by the price of the item.

Collect an additional $31.92 from the customer for sales tax. Then, remit the sales tax to the appropriate government. If your business has nexus in several locations, you might need to collect and remit sales tax for other states, too. Nexus occurs when your business has a presence in a state. You must collect sales tax if your business has a presence in a state that imposes sales tax. AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps.

Author: Stephen L Nelson